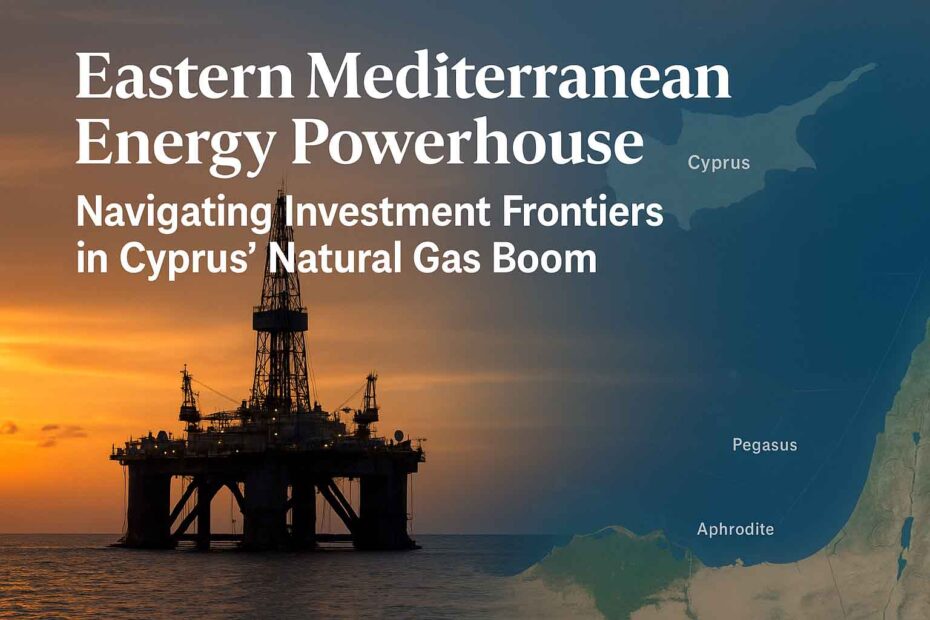

Eastern Mediterranean Energy Powerhouse

Navigating Investment Frontiers in Cyprus’ Natural Gas Boom

Introduction: Cyprus on the Energy Map

Cyprus has long been a magnet for international investment, owing to its strategic location at the crossroads of Europe, Asia, and Africa. Traditionally celebrated for its tourism, real estate, and shipping sectors, the island has in recent years been making headlines for a very different reason — its emergence as an energy player in the Eastern Mediterranean. The discovery of significant offshore natural gas reserves has set in motion a new wave of opportunity that has the potential to transform Cyprus’ economy, strengthen its geopolitical position, and diversify its investment landscape.

The energy story of Cyprus is not merely about hydrocarbons beneath the seabed. It is about the infrastructure to bring those resources to market, the partnerships to ensure their development, and the strategies to leverage revenues for sustainable growth. For investors, this is a moment of convergence — where resource development meets technology, regional diplomacy, and long-term economic planning. Understanding this evolving environment is essential for anyone looking to position themselves advantageously in the years ahead.

Pegasus-1: A New Discovery with Strategic Implications

The latest chapter in Cyprus’ energy journey began with the announcement of a new natural gas discovery, Pegasus-1, located southwest of the island. Discovered through a partnership between ExxonMobil and Qatar Energy, Pegasus-1 adds to the growing portfolio of offshore reserves that have placed Cyprus firmly in the spotlight of the global energy industry.

While detailed reserve estimates are still forthcoming, preliminary indications suggest a substantial deposit that could rival or complement the existing Aphrodite field. The geological profile of Pegasus-1 indicates promising commercial viability, with reservoir quality and depth favourable for efficient extraction. This discovery strengthens the narrative of Cyprus as an energy-rich nation capable of contributing to regional supply security.

For investors, Pegasus-1 represents both a direct and indirect opportunity. Direct investment potential exists in exploration, drilling, and future production phases, particularly for firms providing offshore engineering, subsea technology, and environmental compliance services. Indirectly, the increased activity in Cyprus’ waters will drive demand for logistics, port services, and skilled labour, as well as stimulate ancillary industries from legal advisory to corporate services.

Aphrodite and the Pipeline to Egypt: Infrastructure as an Investment Catalyst

While new discoveries grab headlines, it is the infrastructure to monetise these resources that often makes the difference between potential and realised value. One of the most significant infrastructure developments in progress is the planned subsea pipeline connecting the Aphrodite gas field to Egypt’s liquefaction facilities. This pipeline, championed by Chevron alongside its partners, represents a critical link in Cyprus’ ambition to become an export-oriented energy hub.

Egypt’s liquefied natural gas (LNG) plants provide a ready-made gateway to global markets, allowing Cyprus to sidestep the complexities and costs of building its own large-scale LNG terminal in the short term. This approach leverages regional cooperation and offers investors more immediate returns on capital deployed in upstream projects.

From an investment perspective, infrastructure projects such as this are particularly appealing for their multi-layered returns. Not only do they generate revenue through construction contracts and engineering services, but they also underpin the long-term export potential of the gas sector. Investors can participate at multiple points along the value chain — from equity stakes in infrastructure companies to supply chain financing and support services.

Cronos on the Horizon: A Project to Watch

Alongside Pegasus-1 and Aphrodite, the Cronos field in Block 6 represents another pivotal development. Operated by TotalEnergies in partnership with Eni, the Cronos project is progressing towards a potential Final Investment Decision (FID) in the near future, with production anticipated by the late 2020s. The involvement of major European energy firms underscores both the technical feasibility and the strategic importance of this asset.

Cronos’ reserves, combined with other Cypriot fields, could position the island as a reliable supplier within the European Union’s energy diversification strategy. This aligns with broader EU objectives of reducing dependency on Russian gas and securing alternative sources from politically stable regions. Cyprus’ EU membership adds an additional layer of attractiveness for investors concerned with regulatory alignment and market access.

For investors, early positioning ahead of the Cronos FID could offer significant upside. Stakeholders in engineering, procurement, and construction (EPC) services, offshore vessel leasing, and energy-related insurance stand to benefit substantially as development ramps up.

The Regional Energy Context: A New Eastern Mediterranean Corridor

The Eastern Mediterranean has rapidly emerged as one of the world’s most dynamic energy theatres. Alongside Cyprus, Israel and Egypt have made notable gas discoveries, and Greece is exploring its own offshore potential. This clustering of resources is prompting discussions around an integrated energy corridor — a network of pipelines, LNG terminals, and shared infrastructure linking producers to European and Asian markets.

For Cyprus, regional integration offers both opportunities and challenges. On one hand, cooperation with neighbours can reduce costs, improve market access, and enhance political stability. On the other, overlapping territorial claims and shifting alliances require careful navigation. Cyprus’ ability to maintain constructive relations with Israel, Egypt, and the European Union will be central to maximising the benefits of its energy endowment.

Investors must therefore approach the Cypriot energy sector with an appreciation for the geopolitical landscape. Political risk analysis, regional intelligence, and diversification strategies are essential components of a robust investment approach in this environment.

Opportunities Beyond the Wellhead

While offshore drilling and production attract the most attention, the investment story does not end at the wellhead. The expansion of the energy sector in Cyprus is set to generate a ripple effect across multiple industries.

1. Maritime and Logistics:

With increased offshore activity comes heightened demand for specialised vessels, supply chain management, and port upgrades. Limassol and Larnaca are poised to benefit from investments in dockside facilities, warehousing, and service hubs catering to the energy industry.

2. Financial Services and Fund Administration:

Cyprus already has a growing reputation as a fund services centre, and energy projects provide an ideal asset class for infrastructure and private equity funds. The introduction of new regulations, such as the Administrators Law, has enhanced the transparency and governance framework for fund administration, making the island more appealing to institutional investors.

3. Technology and Innovation:

The energy sector’s needs for advanced monitoring, data analysis, and automation present opportunities for Cyprus to strengthen its technology sector. Companies specialising in subsea robotics, environmental monitoring systems, and AI-driven predictive maintenance could find fertile ground for growth.

4. Skills and Education:

Long-term energy development will require a skilled workforce, creating opportunities for investment in vocational training and higher education partnerships. Collaboration between academia, industry, and government can ensure that Cyprus builds the human capital necessary to support sustained sector growth.

Risks and Mitigation Strategies

As with any major investment environment, Cyprus’ energy sector carries risks that must be understood and managed.

Geopolitical Risk:

The Eastern Mediterranean is a region where maritime boundaries remain contested. Disputes with Turkey over exclusive economic zones (EEZs) have the potential to create tensions. While international law supports Cyprus’ claims, investors must factor in the possibility of political friction and plan accordingly.

Commodity Price Volatility:

Natural gas prices are subject to global market forces, including seasonal demand fluctuations and competition from alternative energy sources. Long-term contracts and hedging strategies can help mitigate exposure to price swings.

Regulatory and Environmental Compliance:

Energy projects in Cyprus are subject to both EU and domestic environmental standards, which can be stringent. Investors should account for potential delays due to environmental impact assessments, as well as the costs of implementing best-in-class environmental management systems.

Infrastructure and Financing Risks:

Large-scale infrastructure projects often face cost overruns and schedule delays. Diversifying investment portfolios and conducting rigorous due diligence on contractors and partners can reduce these risks.

Strategic Recommendations for Investors

Based on current developments, several strategic pathways emerge for investors seeking to capitalise on Cyprus’ natural gas boom.

1. Upstream Participation:

For those with the technical capability, direct involvement in exploration and production offers the highest potential returns. This could take the form of equity partnerships with existing licence holders or participation in future bidding rounds for offshore blocks.

2. Midstream and Infrastructure Investment:

Investing in pipelines, compression stations, and LNG handling facilities offers steady, infrastructure-backed returns. Partnerships with established operators can mitigate technical and operational risks.

3. Ancillary Services and Supply Chains:

Companies providing maritime services, offshore equipment, or logistical support can capture consistent demand as drilling and production activities increase.

4. Renewable Energy Integration:

Forward-looking investors may explore the synergy between Cyprus’ gas development and its renewable energy ambitions. Gas can serve as a transitional fuel, complementing the growth of solar and wind projects. Hybrid investment portfolios that balance hydrocarbons with renewables can offer resilience over the long term.

5. Fund Structuring and Asset Management:

Institutional investors can explore Cyprus as a base for energy-focused investment funds, taking advantage of the island’s evolving legal and financial framework to attract global capital.

Leveraging Energy Revenues for Broader Economic Development

A critical question for Cyprus is how to deploy revenues from natural gas to support broader economic objectives. Experience from other resource-rich nations suggests that prudent management is essential to avoid the so-called “resource curse”.

Key strategies include:

- Establishing a sovereign wealth fund to manage gas revenues and invest in long-term national priorities.

- Allocating a portion of revenues to infrastructure upgrades across transport, digital networks, and public services.

- Supporting diversification into sectors such as ICT, education, and healthcare to ensure economic resilience.

By embedding energy revenues into a diversified growth model, Cyprus can ensure that the benefits of the natural gas boom are felt across society and sustained beyond the lifespan of the resource.

Conclusion: A Defining Decade Ahead

Cyprus stands at a pivotal moment in its modern economic history. The convergence of new gas discoveries, advancing infrastructure projects, and strong regional partnerships presents an unprecedented opportunity to transform the island’s economic landscape.

For investors, the Cypriot natural gas sector offers a spectrum of possibilities — from direct participation in exploration and production to strategic positions in infrastructure, services, and supporting industries. The rewards are potentially significant, but so too are the complexities of operating in a geopolitically sensitive region.

The coming decade will determine whether Cyprus can translate geological promise into lasting prosperity. Success will depend not only on technical execution and market conditions but also on the nation’s ability to manage resources wisely, foster regional cooperation, and integrate the energy sector into a broader vision of sustainable growth. For those prepared to navigate its unique blend of opportunity and challenge, Cyprus’ emerging role as an Eastern Mediterranean energy powerhouse offers a compelling investment frontier.